Market research is the foundation of winning GSA Schedule contracts. With over $45 billion in transactions in 2023, understanding government purchasing trends, competitor pricing, and agency priorities is essential for businesses – especially small ones – looking to succeed in federal contracting. Here’s what you need to know:

Key Takeaways:

- Why It Matters: Only 4% of businesses succeed in navigating the GSA process without challenges. Research helps identify less competitive niches and align your pricing with federal budgets.

- Top Tools:

- GSA eLibrary: Analyze competitors and product categories.

- CALC: Benchmark labor rates for services.

- SSQ+: Track sales trends and high-demand products.

- FPDS: Review federal spending over $10,000 by agency or sector.

- SAM.gov: Monitor active solicitations and contract awards.

- Federal Buying Insights: Agencies like DHS and VA have predictable spending patterns, often surging in Q4. Knowing these trends can help you time your bids effectively.

- Professional Support: Experts like GSA Focus can streamline research, reduce errors, and identify lucrative opportunities.

Quick Overview:

| Tool | Use Case | Best For |

|---|---|---|

| GSA eLibrary | Competitor and contract analysis | Positioning your business |

| CALC | Labor pricing research | Service-based businesses |

| SSQ+ | Sales trend tracking | Identifying growth areas |

| FPDS | Spending analysis | Long-term market insights |

| SAM.gov | Solicitation monitoring | Ongoing opportunity tracking |

With the right research and tools, you can navigate the federal marketplace efficiently, find untapped opportunities, and set competitive prices. Ready to explore? Let’s dive deeper into how to make GSA market research work for you.

buy.GSA.gov – A Smart Place to Do Market Research

Key Tools for GSA Contract Market Research

When diving into GSA contract market research, leveraging federal databases is a must. These tools provide invaluable insights into procurement trends, helping businesses analyze competitors, track federal spending, and find opportunities to position themselves effectively in the government market.

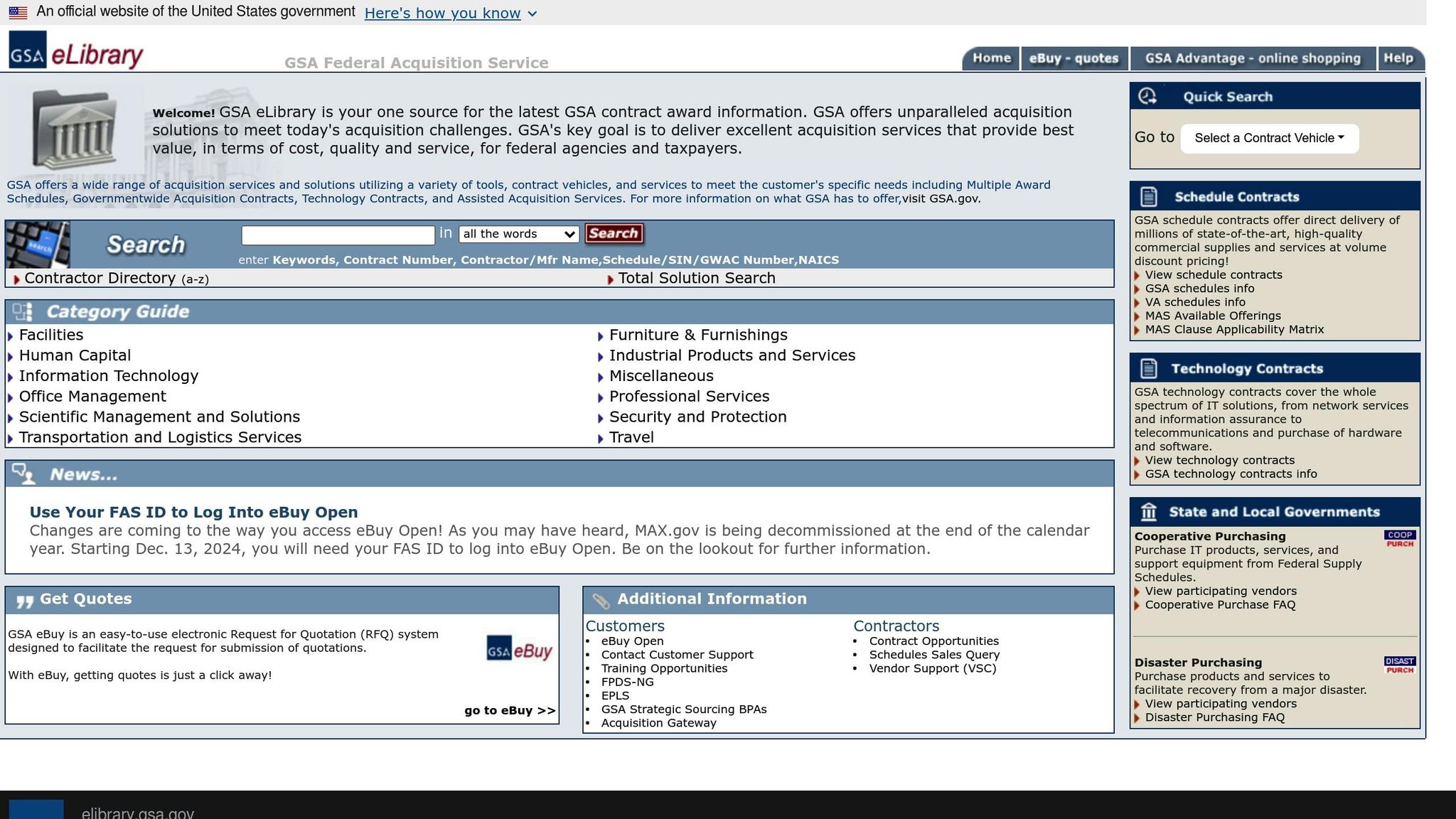

GSA eLibrary

The GSA eLibrary is your go-to resource for exploring contract awards, vendor details, and product categories across all GSA Schedules. Whether you need to search by contract number, vendor name, or product category, this platform simplifies the process, making it easier to conduct targeted market analysis.

CALC (Contract Awarded Labor Category)

For businesses offering services, CALC is a game-changer. It provides detailed labor pricing data, allowing you to filter results by education, experience, and business size. This tool is especially useful for benchmarking your proposed hourly rates against actual contract awards, ensuring your pricing aligns with industry standards.

Schedule Sales Query (SSQ+)

If you want to identify which products or services are in high demand, SSQ+ is the tool to use. It offers sales data and performance metrics for GSA Schedule contracts, helping businesses spot trends and uncover growth opportunities before committing to major investments.

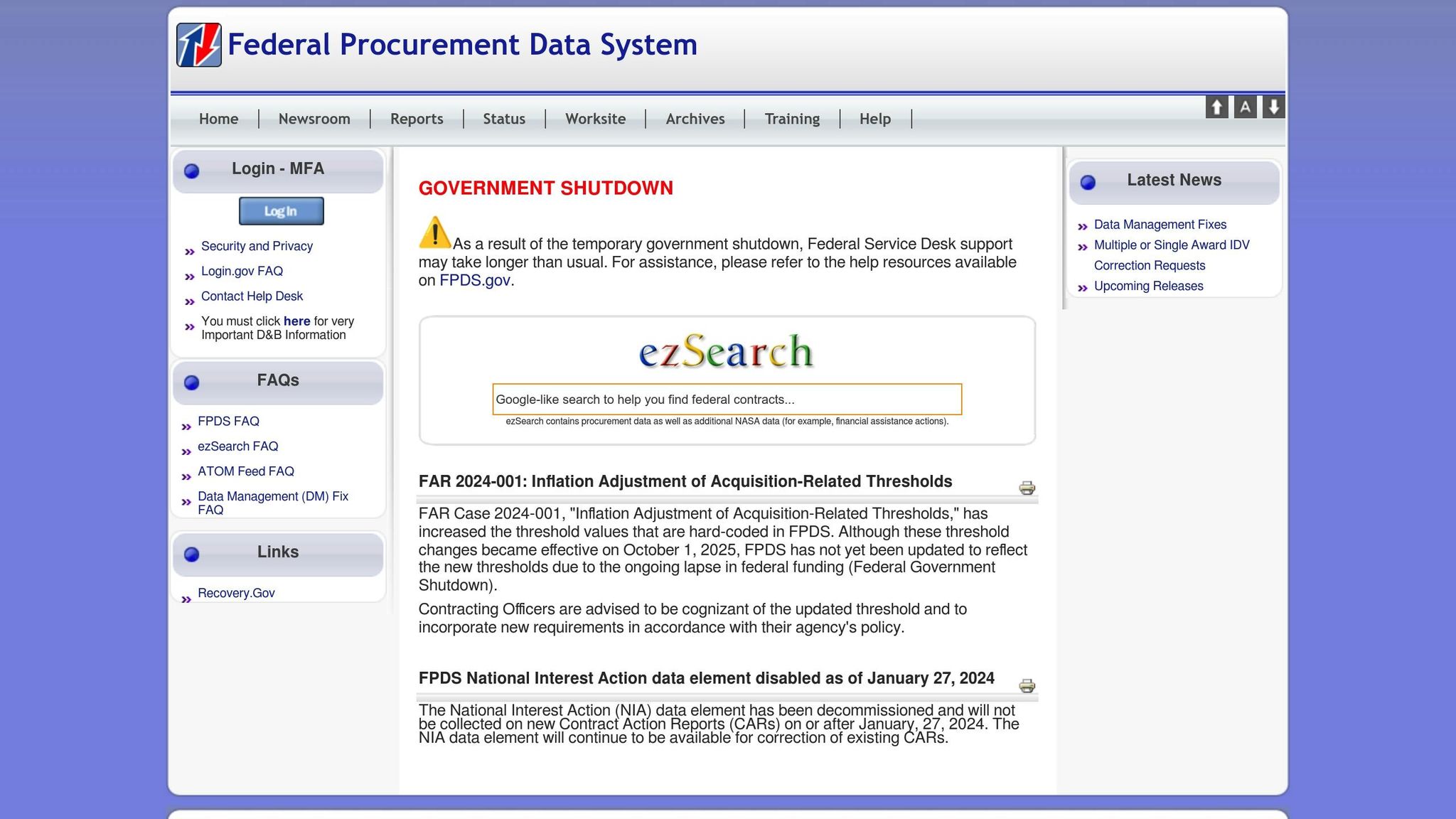

FPDS (Federal Procurement Data System)

The Federal Procurement Data System (FPDS) is a treasure trove of information on federal spending. It tracks all purchases over $10,000 and provides historical and current data. With its advanced search features, you can analyze spending by agency, product category, or contract type, giving you a clear picture of market size and potential.

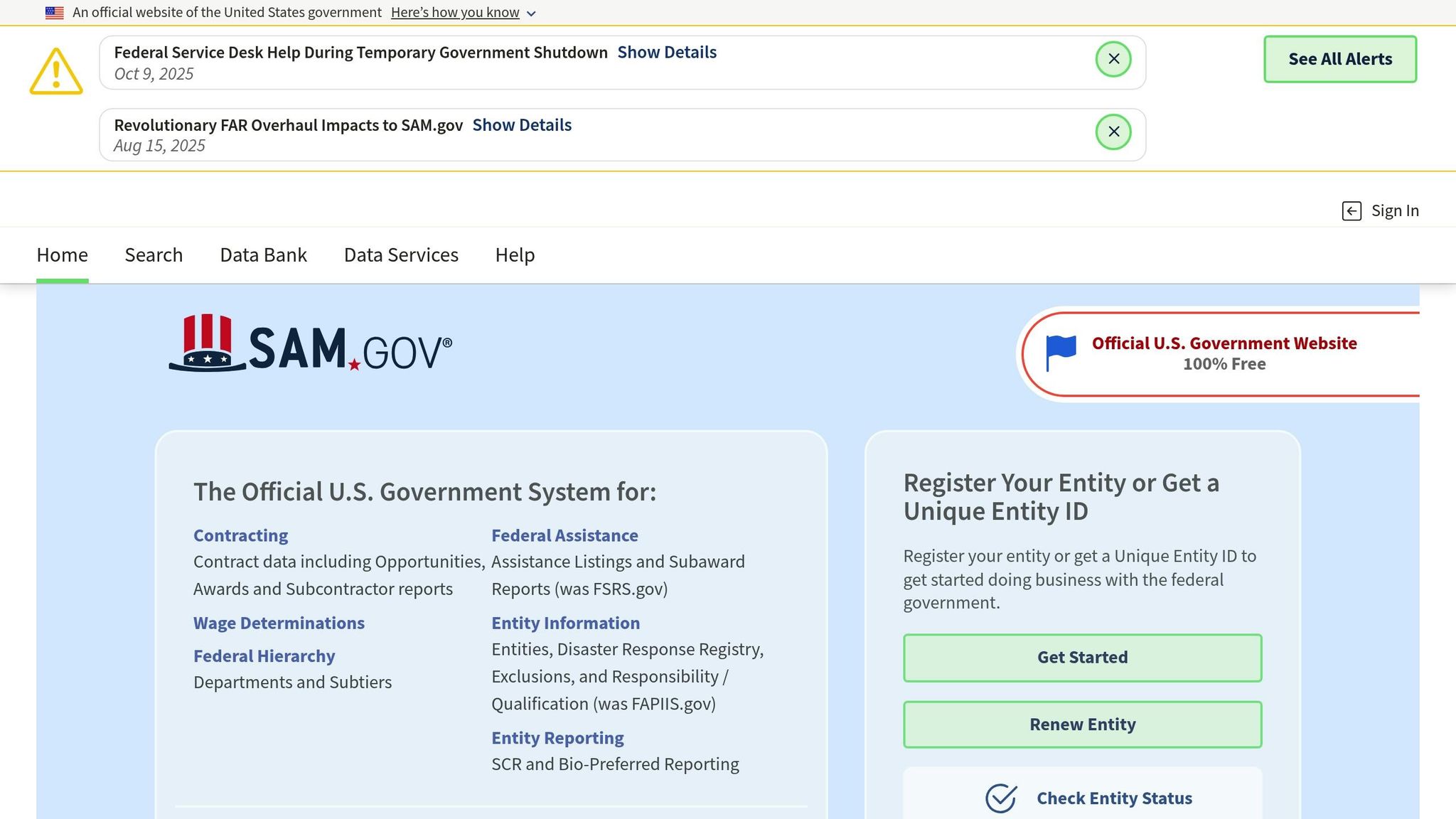

SAM.gov

SAM.gov serves as the federal contracting epicenter. Beyond its role in vendor registration, it combines active solicitations, contract awards, and agency information into one platform. This makes it an essential tool for tracking opportunities, understanding agency structures, and staying informed about the latest developments in federal contracting.

| Tool | Primary Use | Key Advantage | Best For |

|---|---|---|---|

| GSA eLibrary | Competitor analysis and contract research | Comprehensive GSA Schedule data | Understanding market positioning |

| CALC | Labor pricing research | Filters by education and experience | Service businesses setting competitive rates |

| SSQ+ | Sales performance tracking | Highlights high-demand products/services | Identifying growth opportunities |

| FPDS | Historical spending analysis | Extensive federal purchase data | Evaluating long-term market trends |

| SAM.gov | Active opportunity monitoring | Centralized solicitation and award data | Ongoing market surveillance |

These tools are indispensable for anyone navigating the GSA contracting landscape, providing the data and insights needed to make informed decisions and stay ahead in the competitive federal marketplace.

How to Conduct GSA Market Research

Navigating the GSA marketplace effectively means diving deep into competitor analysis, gauging federal demand, and setting strategic pricing. These steps not only refine your GSA application but also position your business for long-term success in the federal contracting space.

Analyzing Your Competition

The federal contracting world is a unique playing field, with far fewer competitors than commercial markets. In fact, about 44% of government awards receive just one bid. This creates opportunities for businesses that truly understand their competition.

"Fewer competitors – Your competition pool shrinks dramatically" – GSA Focus

Start by exploring the GSA eLibrary to find companies offering similar products or services within your target SINs (Special Item Numbers). Pay attention to their contract terms, pricing structures, and product descriptions. This research can help you identify gaps where your business can stand out. Interestingly, high competition doesn’t always spell doom – contracts with more bids often face performance issues, meaning exceptional delivery can give you a real edge.

Once you’ve scoped out the competition, it’s time to assess how demand influences the market dynamics.

Measuring Federal Demand

The scale of opportunity in the GSA Schedule program is immense, with over $51 billion in annual sales flowing through the system. To measure demand for your specific offerings, dig into historical spending data using FPDS (Federal Procurement Data System). Look at contracts similar to what you plan to offer and track spending trends over the past three to five years. This analysis can reveal which agencies are consistently purchasing products or services like yours, along with any seasonal or budget-driven trends.

Tools like SSQ+ can help you identify the most in-demand offerings within your target SINs. By cross-referencing this data with agency spending patterns, you can zero in on which products or services are thriving. With these insights, you’ll be better equipped to tailor your approach – and set prices that align with market expectations.

Setting Competitive Prices

Pricing is a critical piece of the puzzle for GSA contracts. Since pricing is negotiated just once, it’s essential to get it right from the start. This ensures your rates align with federal budgets while remaining profitable for your business.

"One-time price negotiation – Lock in fair pricing upfront with our expert help." – GSA Focus

For service-based offerings, use tools like CALC to research labor pricing. Filter results by education level, experience, and company size to find comparable rates. If you’re selling products, leverage pricing data from the GSA eLibrary and SSQ+ to understand market benchmarks. Your goal is to strike a balance: competitive enough to win contracts while ensuring your business thrives. Don’t forget to factor in elements like volume discounts, geographic pricing variations, and contract durations to fine-tune your strategy.

Finding Niche Markets

One way to stand out is by targeting niche markets. Look for underserved SINs where agency spending is steady, and demand is strong. These areas often allow businesses to command premium pricing while building strong relationships with government buyers. Focus on SINs with fewer contractors and consistent purchasing trends over several years; these often signal unmet agency needs with limited vendor options.

Emerging sectors or specialized services tied to current government priorities can also offer lucrative opportunities. Additionally, geographic niches can be advantageous. Some regions may have high demand for specific services but fewer local contractors. If your business can provide on-site support or faster response times, this could give you a competitive edge. By analyzing agency-specific spending patterns, you can uncover unique requirements that existing vendors aren’t fully addressing, giving you a chance to meet those needs more effectively.

Understanding Federal Buying Patterns

Federal agencies operate within structured budget cycles and mission-focused priorities, resulting in predictable purchasing behaviors. Recognizing these patterns is key to aligning your offerings with government needs.

Learning Agency Priorities

Each federal agency tailors its procurement needs to its specific mission and budget. For instance, the Department of Homeland Security (DHS) often invests in IT services and security equipment, while the Department of Veterans Affairs (VA) prioritizes medical equipment and healthcare services. By understanding these agency-specific preferences, you can better align your GSA Schedule offerings with their core demands.

Here’s a snapshot of major agencies’ fiscal habits and product preferences:

| Agency | Fiscal Year-End Spending (%) | Preferred Product Categories | Notable Buying Pattern |

|---|---|---|---|

| DHS | 35% | IT Services, Security Equipment | Heavy Q4 spending, small business set-asides |

| VA | 40% | Medical Equipment, Healthcare Services | Q4 contract surge, recurring vendor relationships |

| DoD | 30% | Logistics, Professional Services | Multi-year contracts, compliance focus |

To uncover agency priorities, explore procurement forecasts and historical spending trends using tools like FPDS. Look for patterns that span multiple years, as these reveal consistent needs rather than one-off purchases. Many agencies publish annual procurement forecasts, which outline anticipated requirements and budget allocations, serving as a guide for aligning your offerings with future opportunities.

Additionally, building relationships with procurement officers can provide invaluable insights. These connections often reveal priorities not yet reflected in public data, helping you understand the rationale behind purchasing decisions and positioning your business ahead of formal solicitations.

Predicting Future Opportunities

Historical procurement data is a goldmine for forecasting contracting opportunities. With the GSA Schedule program accounting for $45 billion in annual spending, identifying trends within this data can help you plan strategically.

Analyze three to five years of spending data in your target categories to uncover seasonal trends, budget cycle influences, and the adoption of new technologies. For example, cybersecurity spending often spikes in the fourth quarter as agencies work to allocate remaining funds before the fiscal year ends on September 30.

Keep an eye on multi-year contract cycles and renewal trends. Agencies frequently prefer vendors with proven track records, creating opportunities for businesses that can demonstrate consistent performance. Monitoring when major contracts are set to expire can position you to compete for these re-awards.

New government initiatives also open doors. Policies, programs, and executive orders often generate demand for specialized products and services. By tracking agency strategic plans, congressional appropriations, and regulatory updates, you can stay ahead of emerging procurement needs. This proactive approach allows you to identify opportunities early and act swiftly.

Staying Updated on Regulatory Changes

Federal procurement regulations are constantly evolving, and these changes can directly impact your GSA Schedule opportunities. Updates to the Federal Acquisition Regulation (FAR) or GSA’s Multiple Award Schedule (MAS) Solicitation can affect everything from eligibility requirements to pricing rules and reporting obligations.

To stay informed, regularly check official sources like GSA.gov and Acquisition.gov, and subscribe to GSA alerts for updates. Participating in GSA webinars and industry days can also provide direct access to policy changes and guidance, including opportunities to ask questions about how updates may affect your business. Professional organizations and federal contracting consultants can further help you navigate regulatory trends and their practical implications.

The impact of these changes can be substantial. For instance, new documentation requirements might delay contract modifications, while updated pricing rules could affect your competitive positioning. Staying informed ensures you can adapt quickly, maintain compliance, and avoid disruptions in eligibility or performance.

Understanding federal buying patterns goes beyond analyzing data. It’s about positioning your business to tap into the consistent demand flowing through the GSA Schedule program. With only 4% of small businesses holding GSA Schedules, mastering these patterns can provide a significant edge in a market where 44% of government awards receive only one bid.

Getting Professional Help with GSA Market Research

When it comes to navigating the complexities of GSA Schedule market research, professional guidance can make all the difference. Federal contracting involves intricate data analysis, strict regulatory compliance, and competitive assessments – tasks that can overwhelm businesses without the right expertise. By working with professionals, companies can simplify these processes and sharpen their overall strategy.

With GSA Schedule contracts generating over $51 billion in annual sales, having expert support is invaluable – especially for businesses new to the process. Professionals can speed up contract approvals, fine-tune pricing strategies, and open doors to high-value opportunities, saving time and reducing costly mistakes.

How GSA Focus Handles Market Research

GSA Focus stands out with 18+ years of experience (44+ combined years) in guiding businesses through the GSA Schedule process. Their approach combines proven research methods with insider knowledge to deliver actionable insights. One key advantage? Their direct relationships with GSA personnel, which they use to streamline contract approvals. As they put it:

"We even have personal contacts at the GSA which we leverage to get you in quicker. (We recently used these personal contacts to adapt ahead of time, anticipating a large change on the GSA’s end… while everyone else was left scrambling, picking up the rubble!)"

Their expertise includes analyzing complex procurement data and utilizing tools like the GSA’s Market Research as a Service (MRAS) program. These resources often prove challenging for businesses to navigate on their own, but GSA Focus simplifies the process and delivers deeper insights.

Getting Better Results with Expert Support

Partnering with experts like GSA Focus can significantly accelerate market research and improve outcomes. Their process is reported to be 4-6x faster than a DIY approach, helping businesses sidestep errors that often lead to delays and wasted opportunities. As they explain:

"We’re 4-6x faster than DIY. When you try to do-it-yourself with GSA, you’ll run into errors that will force you to restart. This happens often. Some compliance issue, or a simple misunderstanding can lead you to waste months of opportunities."

GSA Focus handles the heavy lifting, completing over 100 hours of research for every 3 hours a client invests. This efficiency, combined with their 98% success rate across more than 600 clients, speaks volumes about their effectiveness. For instance, their research has shown that 44% of government awards receive only one bid, revealing opportunities in a market that’s less crowded than many assume.

Their proactive approach to compliance ensures clients stay ahead of evolving regulations. By anticipating changes rather than reacting to them, GSA Focus helps businesses avoid disruptions and uncover new opportunities.

Accessing More Opportunities with GSA Focus

GSA Focus goes beyond simply securing contracts – they aim to identify lucrative niches where competition is minimal, and demand is high. Their market research uncovers what they call "High-Value, Low-Competition Bids", enabling clients to seize opportunities that might otherwise go unnoticed.

The results speak for themselves: on average, GSA Focus clients add $927,000 in consistent revenue to their bottom line and achieve an impressive 87x ROI. Even businesses with no prior experience in government contracting – 57% of their clients – have succeeded thanks to GSA Focus’s expert guidance.

Their support extends to pricing strategies, ensuring clients strike the right balance between competitiveness and profitability. By handling over 95% of the paperwork and compliance, GSA Focus allows businesses to focus on growth while they handle the complexities of federal contracting.

In a market that is far less saturated than the commercial sector and offers significantly larger contract values, GSA Focus transforms federal contracting into a strategic advantage. Their expertise ensures businesses are well-positioned to capitalize on these opportunities effectively.

Market Research Best Practices for GSA Success

Navigating the federal marketplace successfully requires a well-thought-out strategy that blends detailed data analysis with smart market positioning. With so many opportunities available, it’s crucial to adopt practices that give you an edge over the competition.

Start with competitive analysis. Dive deep into pricing, service offerings, past performance, and contract modifications. But don’t stop there – price alone doesn’t tell the whole story. Take the time to understand the broader competitive environment. Sometimes, unexpected opportunities lie outside the obvious competitors.

Focus on niche markets. Instead of battling it out in crowded spaces, zero in on less saturated niches where government needs are underserved. This approach is gaining traction as businesses realize the value of targeting specific agency requirements or specialized services. By addressing these overlooked areas, you can avoid unnecessary competition while meeting unique demands.

Use performance as your standout feature. Contracts awarded through competitive bidding often face performance challenges. Showcasing your ability to deliver consistent, high-quality results can set you apart. Analyzing past performance issues in your industry can highlight areas where you can excel and build trust with government buyers.

Monitor federal buying trends and policy changes. Reviewing procurement data from previous years and staying updated through resources like GSA announcements, the Federal Register, and industry publications can provide key insights. Government agencies often follow predictable spending cycles, so understanding these patterns helps you plan your marketing and proposal efforts more effectively.

Verify demand across multiple data sources. Before committing resources to a particular market segment, cross-reference information from platforms like GSA eLibrary, FPDS, and SAM.gov. Relying on just one source can leave gaps in your understanding, so a comprehensive approach ensures you’re making well-informed decisions.

Give yourself enough time for thorough research. Quality market analysis isn’t something you can rush. Build in enough time to identify trends and gather insights before making big decisions about your GSA Schedule strategy. Patience and discipline in this phase can pay off significantly in the long run.

Document your findings systematically. Keeping detailed records of your research not only helps you track trends over time but also makes it easier to collaborate with team members or consultants. A well-maintained reference can be an invaluable tool as you pursue future opportunities.

Given the complexities of federal procurement and the constant changes in policies, working with an expert can make a world of difference. Professional advisors, like those at GSA Focus, can help simplify the research process and open doors to new opportunities.

FAQs

How can small businesses use GSA market research tools to find less competitive opportunities in federal contracting?

Small businesses have a valuable resource in GSA market research tools when it comes to identifying less crowded niches in federal contracting. By diving into procurement trends, pricing information, and agency buying patterns, businesses can pinpoint opportunities that align with their strengths while steering clear of highly competitive areas.

These tools enable businesses to fine-tune their strategies, focus on specific agencies, and stand out in the federal marketplace. Using this data not only streamlines the process but also boosts the odds of landing contracts.

Why is it important to understand federal buying patterns, and how can this help businesses time their GSA Schedule bids effectively?

Understanding how federal agencies approach their purchasing decisions is key for businesses looking to thrive with GSA Schedule contracts. Federal procurement often follows a predictable rhythm, with spending surging as the fiscal year comes to a close on September 30. By keeping an eye on these patterns, businesses can strategically plan their bids to align with the times when agencies are most active in making purchasing decisions.

Digging into these buying patterns also reveals which products or services are in high demand. With this insight, businesses can fine-tune their offerings to meet federal needs more effectively. Not only does this increase the likelihood of securing contracts, but it also lays the groundwork for building lasting relationships with federal buyers.

Why is it crucial to set competitive prices when applying for GSA Schedule contracts, and what tools can help with this?

Setting the right prices from the beginning is crucial for success with GSA Schedule contracts. Why? Because it ensures your products or services meet market expectations while also complying with GSA’s strict pricing rules. When your pricing is competitive, it not only attracts federal buyers but also reduces the risk of delays or rejections during the application process.

To get a clear picture of pricing trends, tools like the GSA Advantage! catalog and other market research platforms are incredibly useful. They help you compare and benchmark your rates effectively. If the process feels overwhelming, teaming up with professionals who specialize in GSA contracts can make things much easier. These experts can guide you in crafting a pricing strategy that checks all the necessary boxes.

Related Blog Posts

- Ultimate Guide to GSA Market Research

- 5 Tools for GSA Competitor Research

- How to Promote GSA Contracts to Agencies

- 5 Steps for GSA Market Research