A GSA Schedule is a contract that lets businesses sell products and services to federal agencies at pre-set prices. To qualify, your business must meet these key requirements:

- Business Age: At least 2 years in operation (or qualify under the Springboard Program for IT).

- Financial Health: Provide profit and loss statements and balance sheets for the past 2 years.

- Commercial Sales: Show a history of selling your product or service commercially.

- TAA Compliance: Products must originate from Trade Agreements Act-compliant countries.

- Past Performance: Submit references or detailed project write-ups.

Why It Matters:

- Simplifies federal sales with pre-set pricing.

- Gives access to federal buyers.

- Offers long-term opportunities (5-year contracts, extendable up to 15 years).

To apply, register at SAM.gov, gather required documents (e.g., financials, sales practices), and submit via the GSA eOffer portal. Managing your GSA Schedule requires regular compliance, reporting, and updates. For help, consult experts like GSA Focus.

What is a GSA Schedule Contract & How to Get a GSA Schedule Contract

Eligibility for a GSA Schedule

Before applying for a GSA Schedule, businesses must confirm they meet the required eligibility standards, legal obligations, and performance expectations.

Eligibility Criteria

To qualify for a GSA Schedule, businesses need to meet several key requirements. At its core, this includes being a U.S.-based company with at least two years of operational history.

| Core Eligibility Requirements | Details |

|---|---|

| Business Age | Must have 2+ years in operation |

| Financial Documents | Provide profit and loss statements and balance sheets for the past two fiscal years |

| Commercial Sales | Must show a documented history of commercial sales |

| Financial Stability | Demonstrate sufficient working capital or reserves to handle federal contracts |

These basic requirements are just the starting point. Businesses must also meet strict legal and ethical standards to proceed.

Legal Compliance

Federal regulations are mandatory for GSA Schedule holders. For instance, products must come from or be significantly altered in countries that comply with the Trade Agreements Act (TAA). Beyond TAA compliance, businesses must also:

- Maintain a strong record of integrity and business ethics

- Offer fair and reasonable pricing structures

- Follow commercial sales practices that align with federal guidelines

- Provide pricing that matches or exceeds the terms offered to your best commercial customers

Proving compliance is essential, but a solid history of successful project execution is just as important.

Performance History and References

Past performance is a critical factor in the application process. Businesses must showcase their capabilities by:

- Submitting at least one detailed project write-up or documentation of a year-long ongoing project for each applicable Special Item Number (SIN)

- Providing evidence that past work meets the quality and timelines federal agencies expect

IT companies may qualify for an exception under the Springboard Program, which allows newer businesses to apply under specific conditions [1]. However, this is a special case and not the standard path.

Meeting these requirements ensures businesses are prepared to handle the responsibilities of a GSA Schedule. While the process may seem rigorous, it’s designed to guarantee that contractors can deliver reliable service to federal agencies.

Steps to Apply for a GSA Schedule

Applying for a GSA Schedule requires careful planning and accurate documentation. Following each step properly can help improve your chances of approval.

Preparing Your Application

Before submitting your application, make sure you’re fully prepared. You’ll need a digital certificate to securely access the GSA eOffer portal. Each DUNS number is eligible for two free certificates.

Key documents you’ll need include:

- Financial statements from the last two fiscal years

- Pathways to Success training certificate

- Commercial sales practices records

- Quality control narratives

- Labor category descriptions

Once everything is in order, you can move on to the submission process.

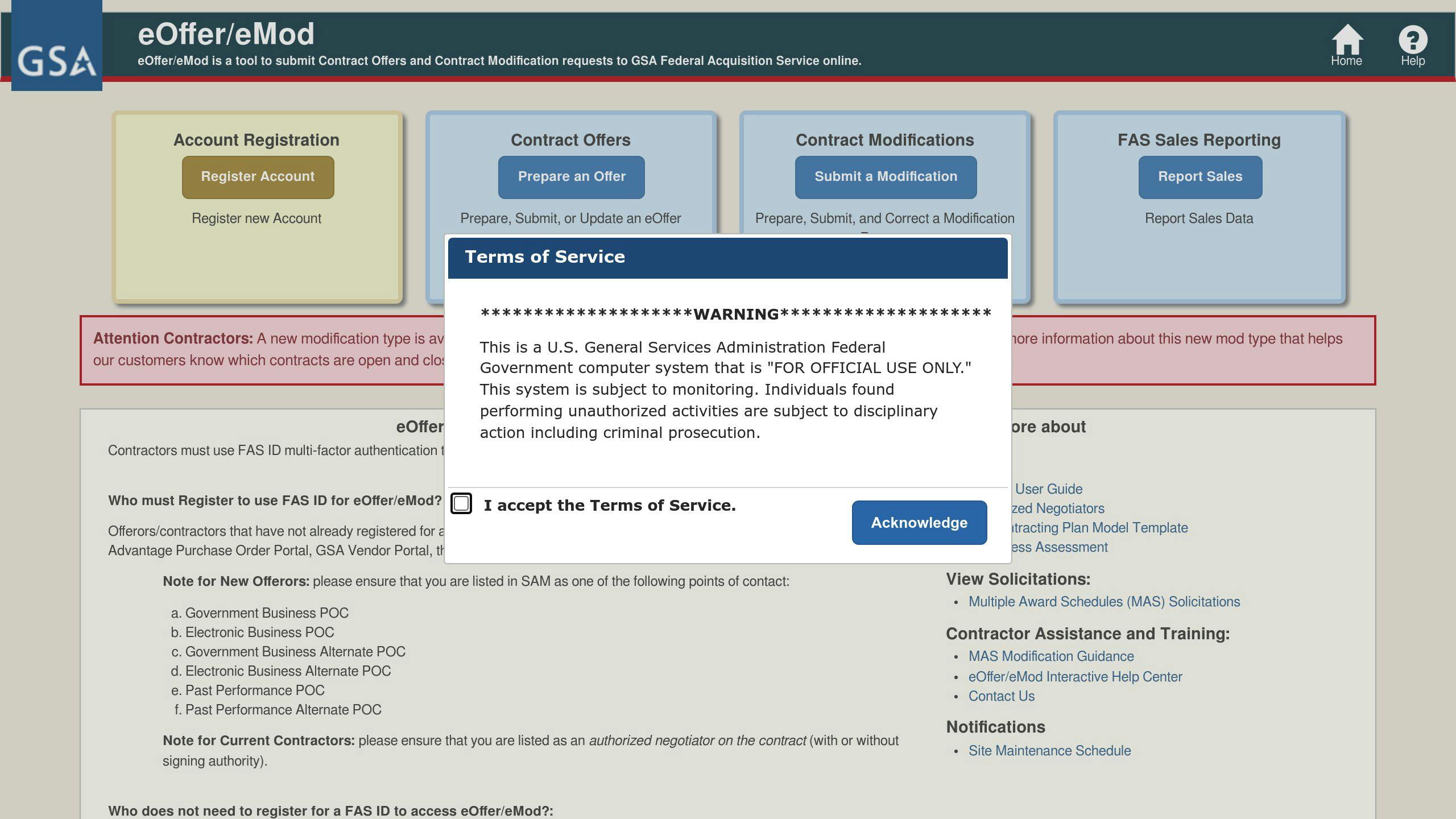

Navigating the GSA eOffer Portal

The eOffer portal is designed to ensure that all submissions meet GSA requirements. Accuracy and thoroughness are essential. The process involves three main steps:

- Authentication

Use your digital certificate to access the system and verify your business credentials. - Offer Preparation

Complete all required sections, upload the necessary documents, and ensure everything follows GSA’s formatting rules. - Final Submission

Review your application thoroughly to confirm it’s complete, then submit it for evaluation.

After submitting, a GSA official will review your application. They may request additional information if needed. For businesses looking to simplify the process, professional services like GSA Focus can provide valuable assistance, helping you prepare documents and ensure compliance to save time and effort.

sbb-itb-8737801

Managing a GSA Schedule

Once you’ve secured your GSA Schedule, staying compliant and managing your obligations is essential for long-term success. This process requires careful attention and regular monitoring of key requirements.

Pricing and Reporting

As a GSA Schedule holder, you’re required to submit sales reports and pay the Industrial Funding Fee (IFF), which is 0.75% of your total sales. Reporting schedules depend on the type:

- Commercial Sales Practices (CSP) reports: Due quarterly on January 30, April 30, July 30, and October 30.

- Transactional Data Reporting (TDR): Due monthly, within 30 days after the end of each month.

Even if you have no sales during a reporting period, you still need to file a report. Accurate reporting is crucial, but it’s just one part of staying compliant with your GSA contract.

Contract Compliance

To keep your contract in good standing, there are several critical tasks to manage:

- SAM.gov Registration: Renew annually to stay active.

- GSA Advantage Catalog: Update your approved price list every two years to reflect your current offerings and pricing.

- Mass Modifications: Review and accept these within 90 days of their release.

Additionally, meeting the minimum sales requirement is non-negotiable. You must achieve at least $100,000 in sales during the first 60 months and $125,000 for each following 60-month period. Regular monitoring is key to avoiding contract termination.

Simplifying Management with GSA Focus

Managing a GSA Schedule can be complex, but professional services like GSA Focus can help. They specialize in contract modifications, compliance tracking, and federal market strategies, making it easier for businesses to maintain their schedules.

Conclusion and Next Steps

Key Takeaways

Getting a GSA Schedule can open doors to federal contracting opportunities, but it requires meeting specific qualifications, keeping accurate records, and staying compliant. To qualify, your business needs at least two years of operation, solid financial health, and a proven ethical track record. Since the process can be complex, working with professionals can improve your chances of success.

Expert Assistance

Josh Ladick and his team at GSA Focus specialize in guiding businesses through the GSA Schedule process. With a 98% success rate, they assist with everything from document preparation to proposal submission and compliance management. Their expertise can help you handle tricky areas such as documentation requirements and contract negotiations, making the entire process smoother.

Steps to Get Started

If you’re ready to pursue a GSA Schedule, here’s how to begin:

- Check Your Readiness: Ensure your business meets the two-year operation requirement, has stable finances, and matches the needs of federal agencies.

- Organize Your Documents: Gather financial reports like profit and loss statements and balance sheets. Collect references that highlight your past performance and reliability.

- Register in SAM: Complete your registration in the System for Award Management (SAM), a mandatory step for federal contractors.

Keep in mind, while a GSA Schedule offers great opportunities, it might not be the best starting point for all new federal contractors. Following these steps will help your business prepare for the process ahead.

FAQs

What does it take to qualify for a GSA Schedule?

To qualify for a GSA Schedule, your business needs to meet the following requirements:

| Requirement | Details |

|---|---|

| Business History | Operate for at least 2 years (or qualify for the Springboard Program) |

| Financial Health | Show stable financial records with positive performance indicators |

| Product/Service Fit | Ensure offerings align with GSA Schedule categories |

| TAA Compliance | Products must originate from TAA-compliant countries |

| Past Performance | Provide CPARS reports or customer references for services |

| Documentation | Complete Administrative, Technical, and Pricing sections |

You’ll also need an active SAM.gov registration and must prove your pricing is competitive. This includes showing that your rates are equal to or better than those offered to your Most Favored Customer (MFC).

For service providers, past performance can be shown through either three CPARS reports or three to five customer references that highlight your expertise.

Meeting these criteria is essential to securing a GSA Schedule and tapping into federal contracting opportunities.

Related Blog Posts

- GSA Schedule vs Direct Federal Contracts: Which to Choose?

- The Stuck Subcontractor who got a GSA Contract…

- GSA Schedule Contract Renewal: Key Requirements

- Top Tools for GSA Competitor Research