Want to win federal contracts? Here’s what you need to know: The U.S. government spent over $650 billion on contracts in 2024, but strict rules make compliance tricky. Key areas to focus on include cybersecurity, reporting, and handling sensitive data under the new 2025 Controlled Unclassified Information (CUI) rules. Small businesses, in particular, face challenges, with 68% struggling with compliance.

Key Compliance Areas:

- Registration: SAM registration is mandatory for eligibility.

- Labor Laws: Follow acts like the Service Contract Act for fair wages.

- Cybersecurity: Defense contracts require CMMC compliance.

- Reporting: Accurate documentation ensures transparency.

What’s New in 2025?

- CUI Rules: Standardized handling of Controlled Unclassified Information.

- Sustainability Reporting: New requirements for environmental data.

- Streamlined Processes: Faster approvals for commercial products.

Pro Tip: Missing compliance can result in fines or bans, like a $500,000 penalty faced by a small business for misrepresentation. Stay ahead by implementing strong risk management, accurate cost tracking, and regular training in cybersecurity and reporting.

Ready to dive deeper? Let’s break down the rules and updates that matter most.

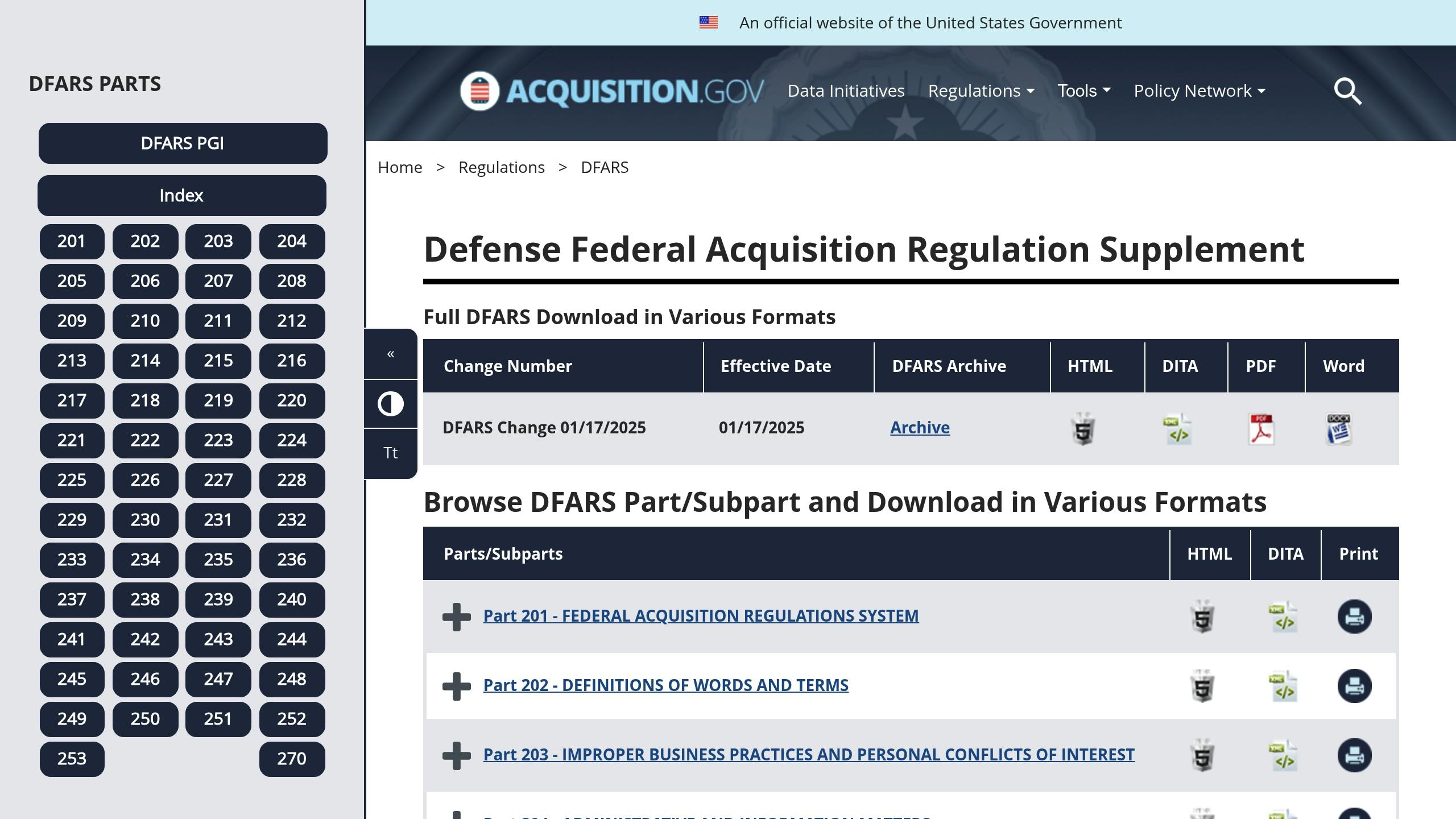

DOD Contract Compliance: DFARS 7012 and CMMC

Main Rules for Federal Contracts

The 2025 FAR updates focus on three major areas: cybersecurity mandates, standardized sustainability reporting, and streamlined approval processes for commercial products [4][1].

FAR Rules and Updates

The 2025 FAR updates aim to tackle ongoing compliance challenges, especially in cybersecurity and reporting.

| FAR Component | Key Requirements | Impact on Contractors |

|---|---|---|

| Part 19 | Small Business Programs | Outlines set-aside procedures and size standards |

| Part 52 | Contract Clauses | Lists mandatory compliance clauses |

| Part 4 | Administrative Matters | Includes SAM registration rules |

| Part 15 | Negotiation Procedures | Explains proposal submission requirements |

CUI Data Rules

The 2025 CUI regulation introduces consistent requirements for handling Controlled Unclassified Information (CUI) across federal agencies. Standard Form XXX will now specify CUI categories.

"The proposed CUI rule would add three new FAR clauses and a new FAR provision establishing contractor requirements for handling CUI in federal solicitations and contracts" [1].

Key contractor responsibilities include:

- Creating System Security Plans

- Reporting incidents within 8 hours

- Ensuring subcontractor compliance through binding agreements

Small Business Rules

The "Rule of Two" continues to play a central role, ensuring contracts are set aside if at least two qualified small businesses are likely to bid.

The 2025 updates introduce:

- Detailed subcontractor utilization reports

- Stronger good faith effort documentation

- Real-time certification updates [2]

These changes add to the challenges faced by small businesses, as highlighted by the earlier statistic showing 68% struggle with compliance requirements.

sbb-itb-8737801

GSA Schedule Rules

The GSA Schedule program includes over 18,000 active contracts, with 78% awarded to small businesses [4]. These contracts typically last for five years with options for renewal, but staying compliant is key throughout the term.

Getting Started with GSA

Securing a GSA Schedule contract means meeting several key requirements:

- TAA compliance: Products must be made or significantly altered in the U.S. or approved countries.

- Documentation: This includes financial records, proof of at least two years in business, and Commercial Sales Practices (CSP) disclosures.

Submitting a technical proposal requires detailed proof that each product complies with the Trade Agreements Act, including documentation on product origins. These rules align with federal priorities such as Controlled Unclassified Information (CUI) compliance and updated reporting standards outlined in FAR. While contractors self-certify compliance, they may still face GSA audits.

Keeping Your GSA Contract

To maintain a GSA Schedule contract, businesses must meet several ongoing requirements:

- Financial obligations: Pay the 0.75% Industrial Funding Fee (IFF) quarterly based on reported sales.

- Sales thresholds: Most schedules require at least $25,000 in annual sales.

- Compliance updates: Keep your GSA Advantage! catalog current and promptly update contracts for pricing or product changes.

Contractors also need to monitor price changes that could trigger the Price Reductions Clause and ensure they submit accurate transactional reporting [7].

GSA Focus: GSA Contract Help

GSA Focus specializes in helping small businesses manage the complexities of GSA Schedule requirements. Their services include:

| Service Area | Key Components | Benefit to Contractors |

|---|---|---|

| Document Preparation | Technical proposals, pricing narratives | Minimizes application mistakes |

| Compliance Management | TAA tracking, pricing updates | Helps maintain compliance |

| Contract Maintenance | Modifications, sales reporting | Eases administrative workload |

With a 98% success rate in securing contracts, GSA Focus also assists with negotiations and compliance monitoring, making the process smoother for businesses.

Pricing Rules and Risk Management

Federal contractors face a maze of pricing regulations while juggling the risks tied to their contracts. GSA compliance is just the starting point – pricing rules add even more layers to the challenge.

BOA and CSP Rules

The Basis of Award (BOA) customer tracking system is central to GSA Schedule pricing compliance. Contractors are required to keep detailed records of BOA customer pricing relationships throughout the contract period. If there are any changes that affect the agreed pricing relationship, these must be reported to GSA within 15 calendar days [3]. BOA tracking works alongside the Industrial Funding Fee reporting required for contract maintenance.

"Accurate and comprehensive CSP disclosures are essential for establishing fair and reasonable pricing and maintaining GSA Schedule compliance", states a GSA audit report [6].

Fixed-Price Contract Rules

Fixed-price contracts made up 63% of federal contract actions in FY 2024 [7], making them the most common type. However, mistakes in these contracts can lead to serious financial consequences, such as the $500,000 penalty for misrepresentation.

To manage fixed-price contracts effectively, contractors should focus on:

- Pre-bid cost analysis: Use historical data to estimate costs accurately.

- Real-time cost tracking: Implement systems to monitor expenses as they occur.

- Scope change documentation: Establish clear processes to handle changes in project scope.

Recent updates in regulations, including Section 889 compliance, bring additional challenges to pricing and risk management. Contractors must integrate these requirements into their pricing strategies during proposal development. This highlights the importance of aligning compliance efforts across all aspects of a contract.

Conclusion: Meeting Federal Contract Rules

Federal contractors face a challenging landscape, balancing cybersecurity, pricing, and GSA compliance requirements while adapting to new regulations like the 2025 CUI mandates.

Key Takeaways

To succeed, contractors should focus on these core areas:

- Regulatory Compliance: The upcoming FAR CUI rule in January 2025 demands strong information security measures to safeguard sensitive data.

- Risk Management: Accurate cost analysis and tracking systems are essential to stay compliant without sacrificing profitability.

For GSA Schedule contractors, success hinges on:

- Regular training in CUI handling

- Establishing reliable information security protocols

- Crafting detailed risk management plans

As regulations shift, aligning compliance efforts with business objectives is critical. Working with experienced partners, such as GSA Focus, can help contractors navigate these challenges while maintaining control and achieving sustainable success [5].

Related Blog Posts

- How to Track GSA Contract Compliance

- How to Manage GSA Contract Performance

- Top 5 Compliance Issues in GSA Contracts

- Ultimate Guide to GSA Compliance Standards